Opinion

Crypto Lending: Too good to be true? (Part 1)

TL:DR Crypto lending today is primarily driven by speculation. Brokerage margin lending is the closest real-world comparison, justifying current crypto rates of 8–10%. As more potential lenders get comfortable with the technical risks, the supply of lenders will start to outweigh the demand of borrowers and margins will eventually compress. While speculation is the primary use case for crypto lending, I am optimistic there will be additional use cases for crypto lending as the technology and ecosystem matures (credit scoring, insurance, etc.)

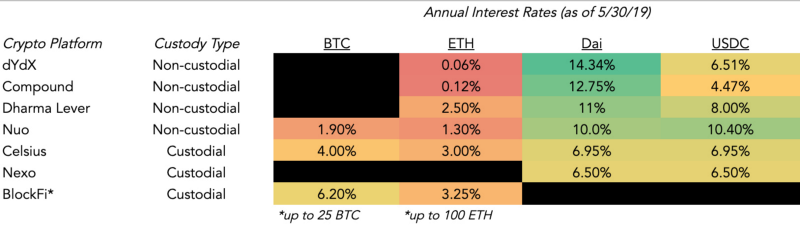

Crypto Lending Annual Interest Rates as of 5/30/19

Crypto lending has grown significantly over the past 18 months and has gained even more attention as of late given attractive interest rates relative to typical savings accounts that earn roughly 2% APR.

Looking at a P2P crypto lending platform like Dharma, lenders can currently earn 8% by lending their USDC, a USD stablecoin formed as a partnership between Circle and Coinbase and 11% for Dai, MakerDAO’s stablecoin that is also designed to be pegged to $1 USD.

On the surface, these rates may sound too good to be true. But, for every lender, there must be a borrower. So who is borrowing at double digit rates?

Crypto Lenders

Because cryptocurrencies are so volatile, almost all crypto loans are over-collateralized. In general, they require collateral ratios of 150%+ to secure a loan, which provides some safe guards for lenders to manage counterparty risk. So a potential borrower would need to put up at least $15,000 worth of crypto (BTC, ETH, etc) as collateral to get a $10,000 loan.

There are two major types of players in the crypto lending market, Custodial and Non-Custodial lenders. The main trade-off between custodial and non-custodial lenders is around Counterparty Risk (trusting a company) vs. Technical Risk (trusting code).

With custodial lending, I am trusting that the entity will safely custody my crypto assets and limit counterparty risk from potential borrowers, ensuring my loan gets paid back in full and on time.

With non-custodial lending, I trust that the smart contract code will run as designed and does not have any bugs that will result in lost funds / hacks.

Centralized, custodial lenders include companies like Genesis Capital, BlockFi, Nexo and Celsius as well as centralized exchanges like Bitfinex, Liquid and BitMEX and centralized OTC desks like Galaxy, OSL and Cumberland.

Decentralized, non-custodial credit protocols include Compound(decentralized money market protocol), Dharma (P2P lending protocol), MakerDAO (decentralized credit facility) and Uniswap (decentralized exchange that enables lenders to provide liquidity).

While there is certainly nuance between all of the above examples, these decentralized protocols are slowly emerging as competitors to centralized, custodial credit providers and differ mainly on lending rates & custody management.

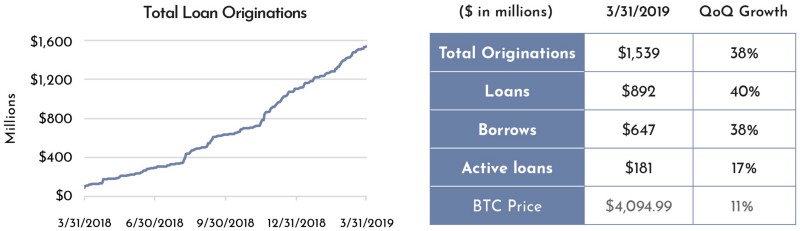

However, centralized providers are still the largest crypto lenders today, with Genesis Capital, originating over $1.5B in annualized volume alone:

Source: Genesis Capital Q1 2019 Insights Report

Click here for Part 2 on Crypto Borrowers and the future of Crypto Lending. Nothing in this material should be interpreted as an offer or recommendation to buy, sell or hold any security or other financial product. Photo credit: Quince

Pingback: Crypto Lending: Too good to be true? (Part 2)