Opinion

Crypto Lending: Too good to be true? (Part 2)

This is Part 2 of a 2 part series. Click here for Part 1 on Crypto Lenders.

Crypto Borrowers

Genesis Capital outlines 3 main use cases for borrowing cryptocurrencies from their clientele:

1. Speculating / Hedging

2. Trading / Arbitraging

3. Operating Working Capital

A majority of crypto-backed loans seem to be speculative in nature, such as gaining additional exposure to a digital asset with leverage, shorting a digital asset you believe may be overvalued or taking advantage of arbitrage opportunities across exchanges.

The crypto community has embraced a cultish culture of “hodling” instead of selling during periods of volatility, so a portion of hodlers are likely using their crypto as collateral for working capital / loans. This can be especially advantageous for US investors as they can avoid tax liabilities by borrowing as opposed to selling their crypto and triggering a taxable event. (disclaimer: this is not tax advice and you should consult an accountant).

Lastly, crypto-native organizations who need operating working capital can take out loans with their balance sheets as collateral. Indeed we saw this happen more frequently in the bear market:

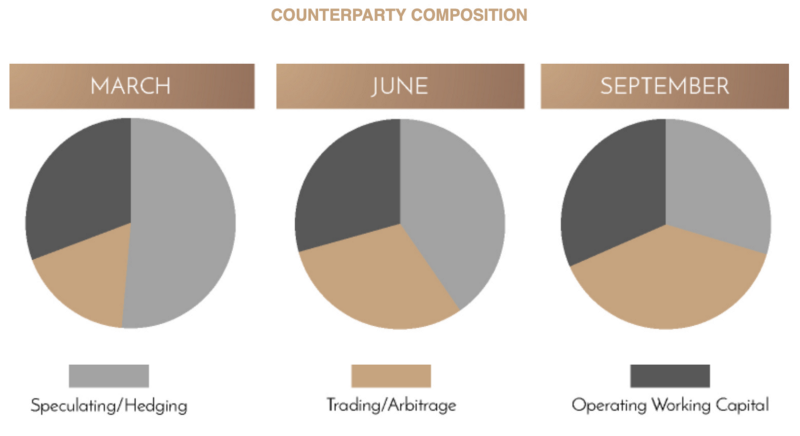

Genesis Capital’s Q3 2018 Digital Asset Lending Snapshot

So out of these three potential borrower bases, we can see roughly 2/3rds of the lending volume in Q3 was driven by speculators / trading activity, rather than accessing working capital. As we emerge from the bear market, I’d speculate that the “working capital” borrowers will become a smaller % of total lending volume as market conditions continue to turn bullish.

Intuitively this makes sense for non-custodial lending activity as well and I’d argue even more of non-custodial crypto lending activity today is driven by speculators.

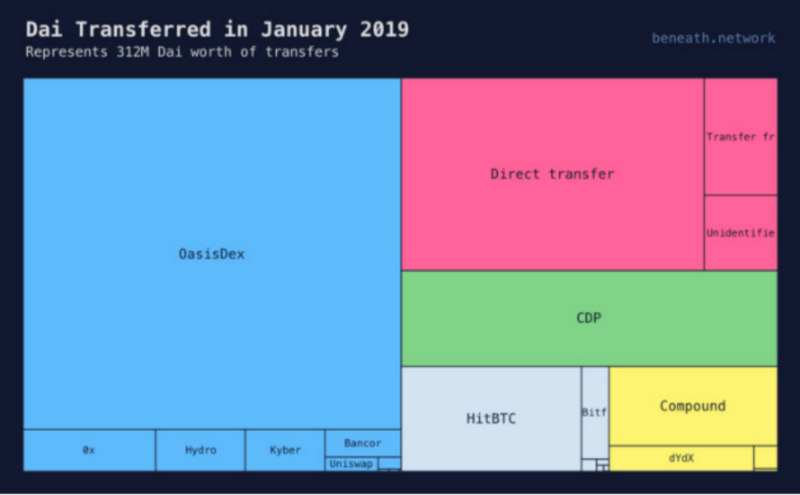

Dai in Numbers post from MakerDAO

Looking specifically at activity by users of MakerDAO’s Dai, we can see a majority of transfers were sent to decentralized exchanges such as OasisDEX (recently rebranded to eth2dai) and centralized exchanges like HitBTC, presumably to purchase cryptocurrencies as ETH is the only trading pair on OasisDEX/eth2dai and HitBTC is a crypto-only exchange (ETH/DAI is by far the most liquid Dai pair on HitBTC with $2.3M in 24h volume compared to $30k for USDT/DAI as of 5/29/2019).

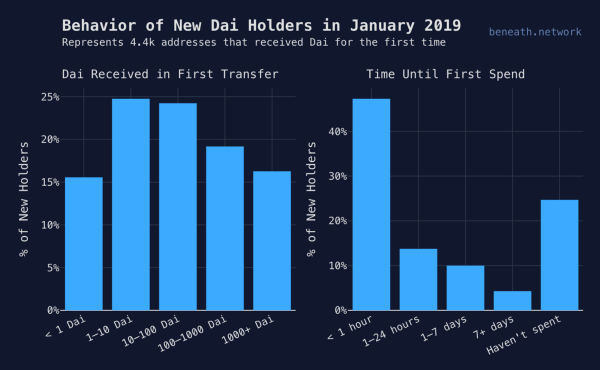

Dai in Numbers post from MakerDAO

The selling of DAI on exchanges for other cryptocurrencies recently caused Dai to de-peg, as holders immediately sell their Dai for other assets (over 45% of Dai is first spent within an hour). Without anything to offset this natural selling pressure, the price of Dai fell under $1.00 in Q1 2019, although it has since rebounded after a series of stability fee increases.

Historical DAI / USDC price on Coinbase

Looking at the operating working capital use case, there has been some anecdotal evidence that crypto projects have been taking loans out via MakerDAO using their ETH treasury holdings as collateral (Aragon’s $1M CDP).

And maybe a portion of DAI-hards are willing to stomach double-digit borrow rates instead of selling their precious ETH…

Yes, there are probably a minority of early adopters who want to avoid a large tax bill…

But the strict over-collateralization requirements of these loans likely means that a retail consumer is likely not the typical borrower. On the aggregate, if a potential borrower needs to take out a loan for working capital (to pay off a bill, mortgage, etc.), wouldn’t they just sell a portion of their 150%+ crypto collateral or use a centralized loan provider at a lower rate before taking on a burdensome 15%+ APR loan?

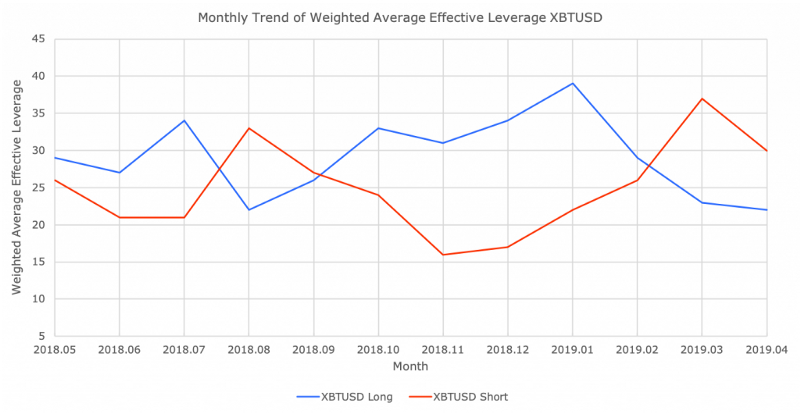

In such a volatile asset class, where Bitcoin can move 20% within an hour, I’d wager speculators are likely the most willing to borrow at these high costs to either gain leverage or short an asset as the profits may outweigh the costs. Crypto is a casino, after-all:

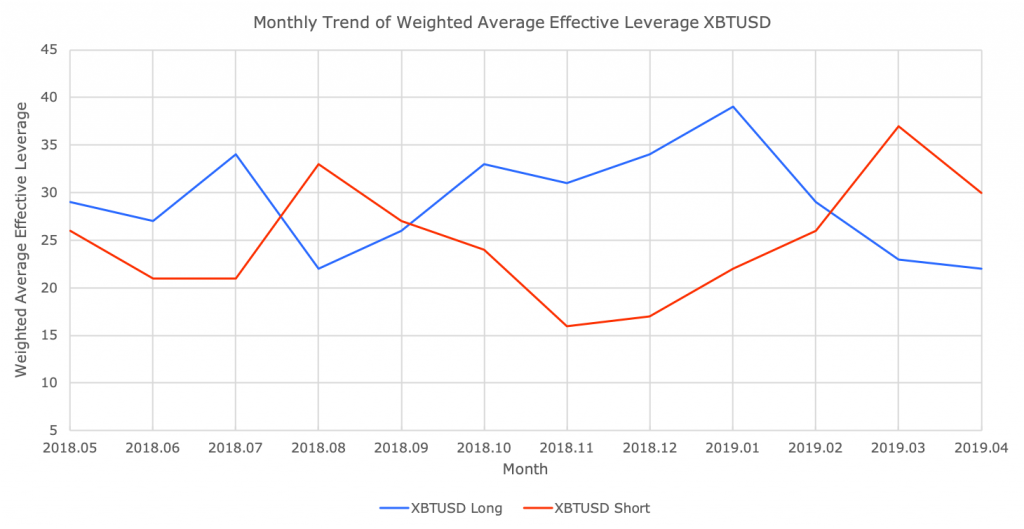

BitMEX average monthly leverage in April was 22x and 30x for Longs and Shorts, respectively.

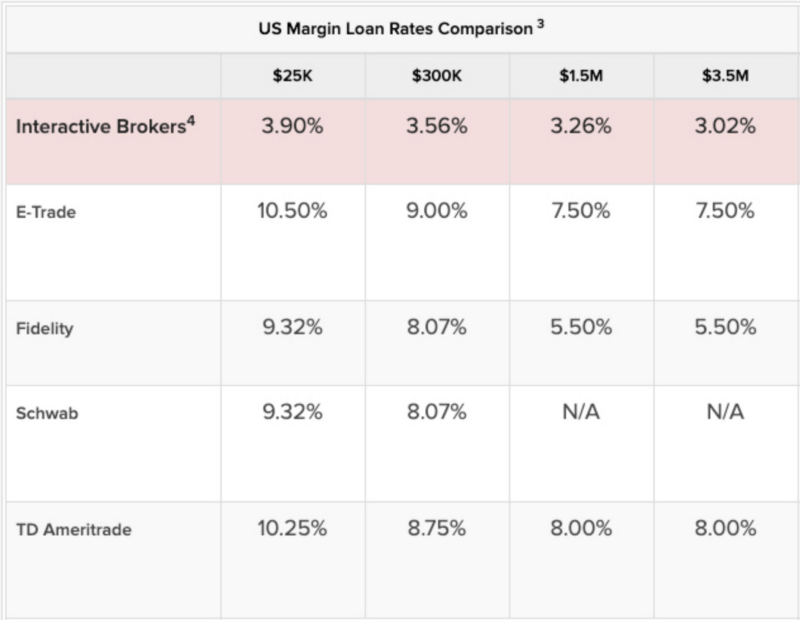

So if we accept the assumption that the majority of crypto lending today is driven by speculators, rather than access to working capital, the closest comparison for crypto lending rates are brokerage margin loan rates. Under that lens, crypto rates start to make a little more sense.

Brokerage margin lending is profitable and relatively low risk given the collateral requirements. However, there is currently no way for the average user to supply capital and earn a profit (unless you are the broker).

The unique innovation in crypto lending is that for the first time, lending platforms are able to open up the supply side via smart contracts. While some custodial lenders like Genesis and BlockFi supply capital and capture the lending margin themselves, other custodial providers like Celsius and Nexo, in addition to non-custodial lenders like dYdX, Dharma and Compound have opted to democratize the supply side.

The big implication being that, for the first time, any one in the world can now supply liquidity to potential borrowers and earn 8–10%+ APR, in a completely permissionless manner. Pretty powerful.

It’s important to note that Ethereum smart contracts are still nascent, and therefore hold a high degree of technical risk (see: Parity multi-sig hack, DAO, etc). While there is currently over $500M+ of ETH locked up in smart contracts across non-custodial lending platforms (a pretty big bug bounty), formal verification tools and the emergence of insurance solutions will slowly lower technical risks, in addition to time.

A few interesting examples of crypto native smart contract insurance providers are defisurance, which leverages Augur prediction markets to insure deposits and Nexus Mutual, a digital cooperative/mutual that covers members against smart contract failure.

While we are still far away from traditional insurance providers securing smart contracts as they have just starting to explore insuring custodians, any centralized / decentralized insurance solution will significantly drive adoption and start to level the playing field vs. centralized lending providers.

After taking into account the technical risks associated with crypto lending, higher APR’s for stablecoins relative to brokerage margin rates start to make sense and are still relatively underpriced given the current state of smart contracts and lack of insurance. Most recently, Zeppelin identified a minor bug in MakerDAO’s governance contract during Coinbase Custody’s audit process. While this bug had minimal impact and wasn’t related to the main set of lending smart contracts, it’s important to be realistic about how nascent this technology is.

The Future of Crypto Lending

To answer the question of how sustainable the current crypto lending markets are, it helps to take a step back and look at the aggregate supply and demand. If we indeed assume that the majority of crypto lending borrowers today are speculators, I imagine the “demand side” will continue to grow as crypto continues gaining adoption and remains a volatile asset class.

However, it’s far more likely that as potential lenders eventually get comfortable with the risk/reward trade-off and realize they too can earn 8%+, the supply side will eventually outpace the current demand from speculators.

The most likely scenario is that crypto lending rates will continue to increase in periods of significant volatility, but decrease on the aggregate as more individuals/entities begin to supply liquidity and enter the space.

What remains to be seen is if crypto lending can start to address new use cases beyond speculation and further grow the demand side. I’m particularly excited to see the emergence of decentralized credit scoring solutions enter the crypto lending space, as they will lower the restrictive 150%+ collateral requirements and open up the supply of potential borrowers.

By combining the powerful innovation of opening up the lending supply side, introducing decentralized credit & insurance solutions, and lowering the cost to serve via smart contracts, I’m optimistic we’ll start to see crypto lending solutions address emerging markets that traditional financial institutions have historically ignored.

Click here for Part 1 of this series. Nothing in this material should be interpreted as an offer or recommendation to buy, sell or hold any security or other financial product.

Pingback: Crypto Lending: Too good to be true? (Part 1)