Opinion

How Blockchain Can Disrupt Internet Monopolies with Network Effects

By

For most startups, attracting users can be a challenge. Although it’s a well understood and solvable problem in most cases (i.e. build a better product), it turns out that a better product isn’t enough to get people to switch away from many internet monopolies due to something called network effects.

What Is a Network Effect?

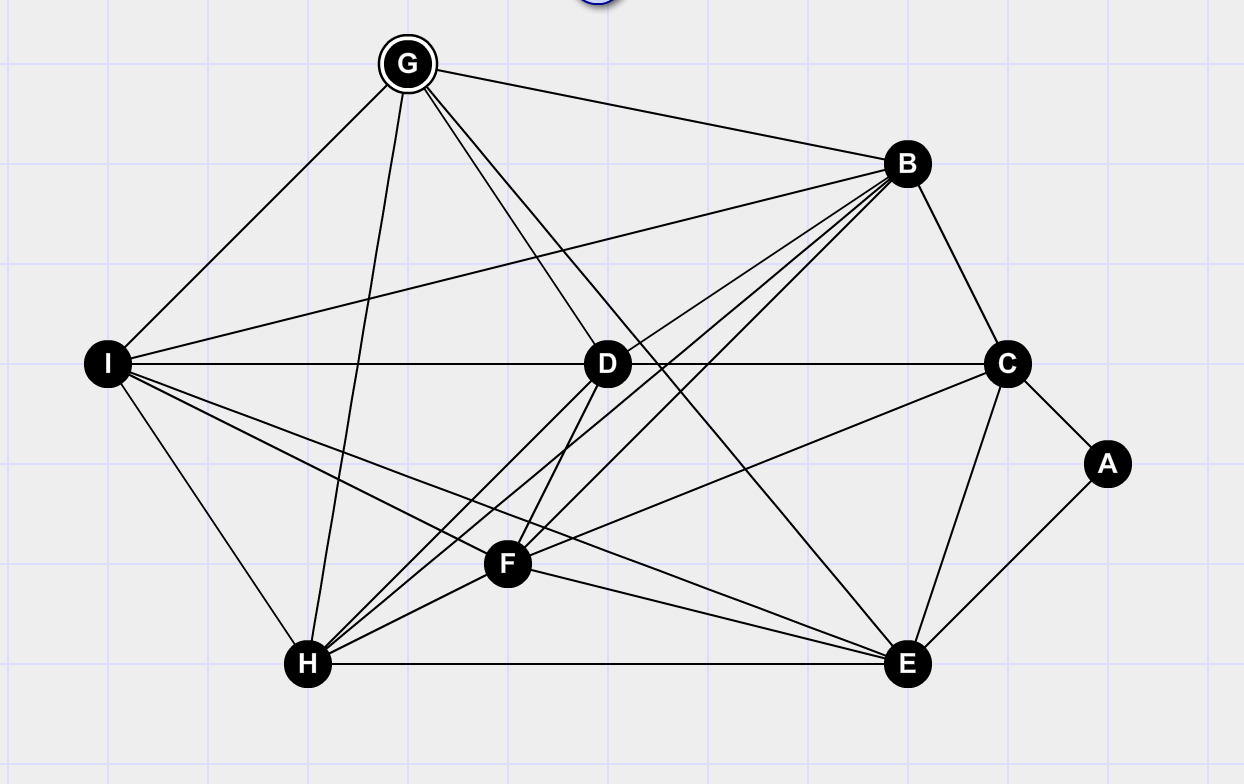

A network effect is the idea that a service becomes more valuable as more people use it. The term was first coined by Jeffrey Rohlfs in a now legendary 1974 paper analyzing telephone systems. His book Bandwagon Effects is an easy to read and witty, but rigorous, review of several network effect businesses.

For example, network effects helped Facebook become a natural near-monopoly. Facebook wasn’t as interesting when you only had a couple of friends using the service. Maybe it was worth checking every once in a while to see updates and photos, but when dozens of your friends joined, something clicked. You had enough minute-by-minute updates that you started checking it all the time. The service as a whole became more valuable to you as the size of your network increased.

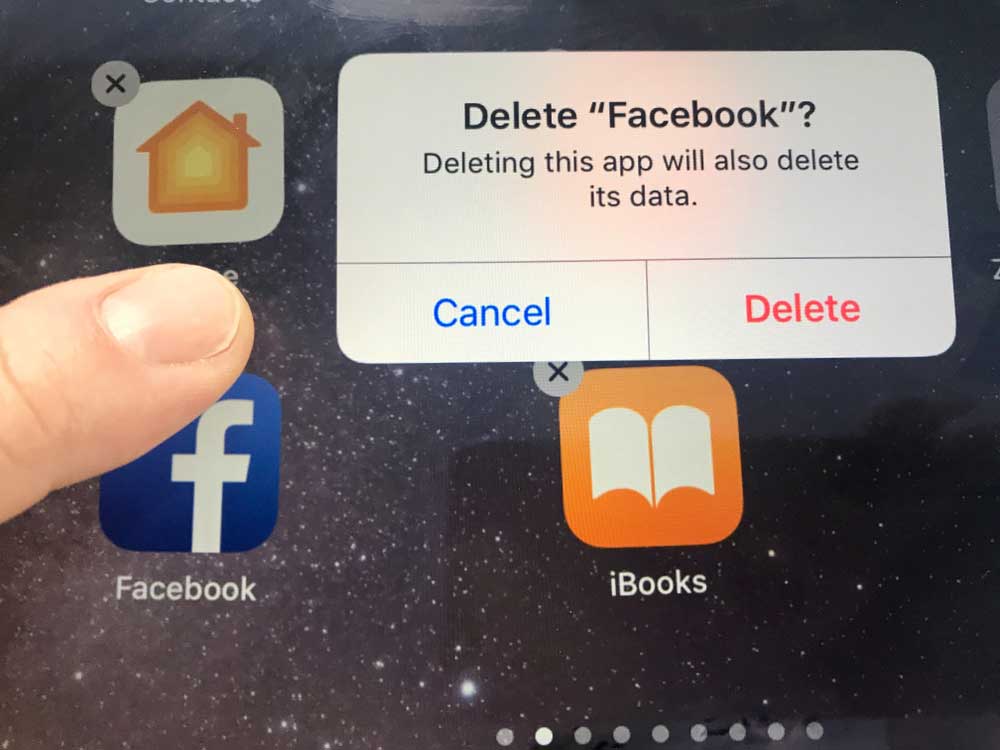

Network effects not only help a business grow, but also prevent users from migrating to competitors. Let’s imagine if you wanted to leave Facebook and go to a competitor. Even if a competitor had better features, or guarded your privacy better, or reflected your values, you really couldn’t switch because your friends aren’t there. And your friends aren’t going to switch if you aren’t there. So it’s pretty tough for that hypothetical competitor to compete by merely providing a better product.

The only way for an incumbent to lose is if it misses out on a major trend (which Facebook almost did to Snapchat due to the rise of mobile video) or if its service becomes almost unusable. In early 2008, it literally took minutes to load a single page on social networking site, Friendster, leading to MySpace’s rise. And MySpace was eventually filled with spam, clutter, and fake profiles, leading to Facebook’s rise.

“(MySpace) was basically this junk heap of bad design that persisted for many many years. There was a period of time where if they had just copied Facebook rapidly, they would have been Facebook. They were giant, the network effects, the scale effects were enormous.” — Sean Parker, Co-founder of Facebook.

Network effects have fueled the rise of many of the Internet services you use every day, like YouTube, Google, Facebook, Ebay, Craigslist, LinkedIn, Snapchat, Pinterest, Instagram, etc.

What’s Wrong With Network Effects?

It can be argued that the Internet supercharged the ability of monopolies to behave badly. The internet’s reach, ubiquity, and open information architecture meant companies could grow explosively. WhatsApp signed up 10% of the world’s population as users just 5 years after launch and 55 employees, based on a perfectly optimized network effect business. Google and Facebook together control one quarter of the global advertising spend, and are each approaching a $1 Trillion valuation. And the nature of internet businesses — information — means that the harm is societal, not just economic. Internet monopolies have encouraged the worst in human nature, increased income inequality, and even profited as their platforms were used to undermine democracy.

The solution is often to regulate monopolies, but the results are often coarse, heavy handed, and suboptimal. Enabling more competition could solve these problems more effectively.

How Cryptocurrencies Support Competition with Network-Effect Monopolies

A startup needs to attract users, but it’s hard to attract users away from a network effect based incumbent. Cryptocurrencies can help startups compete with incumbents who are benefiting from network effects. Bitcoin has paved the way toward leveling the playing field for start-ups competing with the Internet monopolies.

Today, a startup can mint its own cryptocurrency and distribute it to users as an incentive to users to try out a service.

Second, the cryptocurrency needs to be valuable. Something has value if there is demand for it. A company can create demand for the cryptocurrency by accepting it as payment for the use of its services. For example, today’s social networks and search engines take US dollars as payment from advertisers. A decentralized competitor could take its own cryptocurrency as payment from advertisers.

Third, the cryptocurrency is used to incentivize users to join the service. This is basically a crypto version of the classic marketing techniques of free trials, reward points, and referral programs. In the crypto world, these have been called airdrops and bounties, and there are many places to find these offers.

Finally, application specific currencies have another attribute that makes them extra useful as a tool to acquire customers: cryptocurrencies can increase in value as a service becomes more valuable. The company can now say to users, “If you believe in our product, stick with us because the cryptocurrency we just gave you should increase in value”. Basically, the early users have a stake in the startup’s success.

Check out the core economics concept of the Quantity Theory of Money for a more rigorous description of how a currency increases in value as it’s used to transact more products and services.

We’re Not There Yet

Although the theory of using cryptocurrencies to compete with a network effect incumbent is sound, it has not yet happened in practice. A few pieces need to fall into place before this theory will work. Blockchains need to rival AWS in speed and cost, support a freemium model, and blockchain-enabled browsers need to be widely adopted (e.g. Trust or Metamask).

The Future of Network Effects

Cryptocurrencies give startups a chance to kickstart their own network effect. And if everyone has this tool, hopefully companies will be forced to compete on delivering better and cheaper products. It would be good for just about everyone if innovation had a fighting chance, if companies couldn’t grow to the size of governments, and companies thought about users as partners rather than the product.

Yaosh is currently CFO of Superlinear, a blockchain startup building tools for dapp developers to create communities. He was previously the Executive Vice President at Miramax, SVP of Corporate Finance at Lionsgate’s streaming networks division, and held senior business development roles at Google, Metro-Goldwyn-Mayer Studios, and The Huffington Post. He was also the founding product manager for Amazon Video. Yaosh holds 3 patents issued and filed. Yaosh graduated with a B.A. in Computer Science from UC Berkeley. He also holds a M.S. in Computer Science from Stanford and a MBA from Harvard. Yaosh is a CFA Charterholder.

Pingback: How Blockchain Can Disrupt Internet Monopolies with Network Effects – The Crypto News

http://ivistroy.ru/

April 29, 2023 at 1:14 AM

Wow, that’s what I was searching for, what a data!

existing here at this weblog, thanks admin of this web page.

rem-dom-stroy.ru

May 3, 2023 at 4:31 AM

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

obshchestroy.ru

May 3, 2023 at 2:04 PM

Wow, incredible blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is great, let alone the content!

remont-master-info.ru

May 3, 2023 at 10:52 PM

hey there and thank you for your information I’ve definitely picked up anything new from right here. I did however expertise some technical issues using this site, since I experienced to reload the site many times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but sluggish loading instances times will often affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective interesting content. Make sure you update this again soon.

Anonymous

May 4, 2023 at 6:27 AM

Why viewers still use to read news papers when in this technological world everything is accessible on net?

smartremstroy.ru

May 4, 2023 at 11:10 PM

Fantastic beat ! I wish to apprentice while you amend your site, how can i subscribe for a blog site? The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear concept

delaremontnika.ru

May 5, 2023 at 2:01 AM

It’s an remarkable article designed for all the internet users; they will get benefit from it I am sure.

nemasterok.ru

May 5, 2023 at 4:22 AM

Wow, marvelous blog format! How long have you been blogging for? you make blogging glance easy. The full glance of your web site is wonderful, let alonewell as the content!

remstrdom.ru

May 5, 2023 at 12:11 PM

Howdy! Someone in my Myspace group shared this site with us so I came to take a look. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Wonderful blog and excellent style and design.

nastroyke-info.ru

May 6, 2023 at 5:38 AM

Good day I am so glad I found your web site, I really found you by error, while I was searching on Aol for something else, Regardless I am here now and would just like to say cheers for a incredible post and a all round enjoyable blog (I also love the theme/design), I dont have time to browse it all at the minute but I have saved it and also included your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the excellent jo.

mirsadovnikov.ru

May 6, 2023 at 11:22 AM

What’s up, its good article concerning media print, we all be familiar with media is a impressive source of information.

glavdachnik.ru

May 7, 2023 at 10:13 AM

Someone necessarily lend a hand to make significantly articles I might state. This is the first time I frequented your web page and so far? I amazed with the research you made to create this actual submit incredible. Wonderful task!

удаление пигментных пятен лазером

May 8, 2023 at 10:29 AM

Hi there, I found your blog by means of Google whilst searching for a similar matter, your web site got here up, it appears good. I have bookmarked it in my google bookmarks.

infoda4nik.ru

May 9, 2023 at 9:12 AM

I like the valuable information you supply in your articles. I will bookmark your weblog and check again here frequently. I am relatively certain I will be informed lots of new stuff right here! Good luck for the following!

ogorodkino.ru

May 10, 2023 at 2:14 AM

you are really a good webmaster. The site loading velocity is incredible. It kind of feels that you are doing any unique trick. Moreover, The contents are masterpiece. you have performed a wonderful process in this topic!

sadovoe-tut.ru

May 10, 2023 at 9:16 AM

Your means of describing everything in this piece of writing is actually pleasant, all can effortlessly understand it, Thanks a lot.

hay day скачать на компьютер

May 10, 2023 at 6:01 PM

Wonderful site you have here but I was curious about if you knew of any community forums that cover the same topics talked about in this article? I’d really love to be a part of online community where I can get advice from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Appreciate it!

hay day скачать на компьютер

May 11, 2023 at 3:15 AM

Spot on with this write-up, I absolutely believe this site needs much more attention. I’ll probably be back again to read through more, thanks for the info!

хранение вещей

May 11, 2023 at 9:36 AM

Hi there, just wanted to say, I enjoyed this post. It was practical. Keep on posting!

Хранение бытовой техники на складе

May 11, 2023 at 4:56 PM

Thanks for one’s marvelous posting! I truly enjoyed reading it, you can be a great author.I will always bookmark your blog and will come back sometime soon. I want to encourage you to continue your great job, have a nice morning!

Хранение бытовой техники на складе

May 12, 2023 at 3:29 AM

Hi to every body, it’s my first pay a visit of this blog; this webpage contains awesome and actually good information designed for readers.

хранение вещей

May 12, 2023 at 11:41 AM

This is a very good tip especially to those new to the blogosphere. Brief but very accurate information Thanks for sharing this one. A must read article!

хранение вещей минск

May 13, 2023 at 2:56 AM

Im not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back later. Cheers

накрутка просмотров яппи

May 14, 2023 at 8:11 AM

I’ve read several good stuff here. Definitely worth bookmarking for revisiting. I wonder how much attempt you set to create this type of wonderful informative site.

просмотры в яппи

May 14, 2023 at 4:56 PM

Hi there mates, its wonderful post regarding tutoringand completely explained, keep it up all the time.

накрутка просмотров яппи

May 15, 2023 at 6:51 AM

Do you have a spam issue on this website; I also am a blogger, and I was wanting to know your situation; many of us have created some nice methods and we are looking to trade solutions with other folks, be sure to shoot me an e-mail if interested.

Карта мира из дерева на стену купить в Минске

May 15, 2023 at 4:22 PM

Hurrah! After all I got a website from where I know how to in fact take helpful data regarding my study and knowledge.

Карта мира из дерева на стену

May 16, 2023 at 2:54 AM

I believe what you postedtypedthink what you postedtypedsaidbelieve what you postedtypedsaidbelieve what you postedwrotesaidWhat you postedtypedsaid was very logicala bunch of sense. But, what about this?consider this, what if you were to write a killer headlinetitle?content?typed a catchier title? I ain’t saying your content isn’t good.ain’t saying your content isn’t gooddon’t want to tell you how to run your blog, but what if you added a titlesomethingheadlinetitle that grabbed a person’s attention?maybe get a person’s attention?want more? I mean %BLOG_TITLE% is a little plain. You could look at Yahoo’s home page and see how they createwrite news headlines to get viewers interested. You might add a related video or a related picture or two to get readers interested about what you’ve written. Just my opinion, it might bring your postsblog a little livelier.

Карта мира из дерева на стену купить в Минске

May 17, 2023 at 5:52 AM

I’m not sure why but this blog is loading extremely slow for me. Is anyone else having this issue or is it a problem on my end? I’ll check back later and see if the problem still exists.

Карта мира с подсветкой

May 17, 2023 at 5:23 PM

Do you have a spam issue on this site; I also am a blogger, and I was wanting to know your situation; many of us have created some nice methods and we are looking to trade strategies with other folks, be sure to shoot me an e-mail if interested.

Карта мира из дерева на стену купить в Минске

May 18, 2023 at 4:16 AM

My brother suggested I might like this blog. He was totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

agrosadovnik.ru

May 19, 2023 at 5:22 AM

Great blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog shine. Please let me know where you got your design. Thank you

body tape for breast

May 20, 2023 at 2:27 PM

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get bought an edginess over that you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly a lot often inside case you shield this increase.

body tape for breast

May 21, 2023 at 10:10 AM

Hi there i am kavin, its my first time to commenting anywhere, when i read this article i thought i could also make comment due to this sensible post.

купить пуговицы Минск

May 22, 2023 at 3:52 AM

An intriguing discussion is worth comment. I do believe that you should write more on this issue, it might not be a taboo subject but generally people do not discuss such topics. To the next! Kind regards!!

Прогон сайта хрумером

May 23, 2023 at 10:49 AM

Hello! I know this is somewhat off topic but I was wondering which blog platform are you using for this site? I’m getting tired of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be great if you could point me in the direction of a good platform.

кровать тахта угловая

May 26, 2023 at 8:20 PM

Woah! I’m really enjoying the template/theme of this website. It’s simple, yet effective. A lot of times it’s very hard to get that “perfect balance” between superb usability and visual appearance. I must say that you’ve done a amazing job with this. In addition, the blog loads extremely fast for me on Opera. Superb Blog!

Трансфер в Шерегеш

June 7, 2023 at 11:02 AM

Hey I know this is off topic but I was wondering

if you knew of any widgets I could add to my blog that automatically tweet my newest twitter

updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some

experience with something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to

your new updates.

http://www.skupkamsk.site

June 14, 2023 at 2:51 AM

скупка золота в москве – золото 1г продать

шкафы-купе на заказ в Твери

June 14, 2023 at 12:30 PM

of course like your web-site however you need to check the spelling on quite a few of your posts. Several of them are rife with spelling problems and I in finding it very bothersome to tell the truth on the other hand I will surely come back again.

логистический склад

June 15, 2023 at 7:50 AM

An impressive share! I have just forwarded this onto a coworker who had been doing a little research on this. And he in fact bought me breakfast simply because I found it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanx for spending the time to discuss this matter here on your internet site.

логистический склад

June 16, 2023 at 7:23 AM

I do agree with all the concepts you have presented on your post. They are very convincing and will definitely work. Still, the posts are too quick for newbies. May just you please extend them a bit from next time? Thank you for the post.

www.bezogoroda.ru

June 17, 2023 at 11:36 AM

You really make it seem so easy with your presentation but I find this topic to be really something which I think I would never understand. It seems too complicated and very broad for me. I am looking forward for your next post, I will try to get the hang of it!

Перекладные фокусы

June 21, 2023 at 10:01 AM

There is definately a lot to know about this topic. I like all the points you’ve made.

Daviscob

June 22, 2023 at 5:47 AM

tamoxifen medicine price

Elwoodgrina

June 22, 2023 at 7:33 PM

piroxicam online

Zakflerm

June 22, 2023 at 9:37 PM

can you buy amoxicillin over the counter

SamuelNug

June 22, 2023 at 9:57 PM

buy clomid canada

Elwoodgrina

June 23, 2023 at 2:52 PM

malegra fxt without prescription

Sueflerm

June 23, 2023 at 3:41 PM

levitra buy online pharmacy

Eyeflerm

June 24, 2023 at 2:17 AM

accutane 2019

Zakflerm

June 24, 2023 at 9:22 PM

buy sildalis

Richardsquab

June 25, 2023 at 5:04 AM

top 10 pharmacies in india

Michaeldic

June 26, 2023 at 3:00 AM

cialis 20mg tablets uk

Alanflerm

June 26, 2023 at 8:55 AM

accutane prices

Alanflerm

June 26, 2023 at 8:36 PM

clomid tablets australia

spravki-kupit.ru

June 27, 2023 at 12:57 AM

получение медицинской справки

Josephfeshy

June 27, 2023 at 12:30 PM

http://edpill.pro/# ed remedies

купить диплом о высшем образовании москва

June 27, 2023 at 9:31 PM

I have been surfing online more than 2 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all site owners and bloggers made good content as you did, the net will be much more useful than ever before.

JamesVow

June 27, 2023 at 11:50 PM

canada drug stores: order prescription medicine online without prescription – canada medicine

Michaeldic

June 28, 2023 at 7:24 AM

furosemide 4 mg

Henrytum

June 28, 2023 at 3:45 PM

top online pharmacies – methadone online pharmacy

WilliamWeike

June 28, 2023 at 6:35 PM

best online pharmacy for viagra : online compounding pharmacy cheapest online pharmacy

Henrytum

June 28, 2023 at 8:12 PM

target pharmacy online – pharmacy school online

WilliamWeike

June 28, 2023 at 9:40 PM

canadian online pharmacy viagra : online pharmacy scams indian pharmacy online

JamesSog

June 28, 2023 at 10:17 PM

https://edpill.pro/# new ed treatments

Henrytum

June 28, 2023 at 10:57 PM

cialis online canadian pharmacy – safe online pharmacy

WilliamWeike

June 29, 2023 at 12:05 AM

free online pharmacy technician practice test : reputable canadian online pharmacy best online pharmacies

Alanflerm

June 29, 2023 at 8:18 AM

bactrim 1600

Luthervions

June 29, 2023 at 2:54 PM

how to play aviator on sportybet aviator game how to play aviator on betway

Josephfeshy

June 30, 2023 at 1:07 AM

https://edpill.pro/# non prescription ed drugs

JamesSog

June 30, 2023 at 4:48 AM

https://fastpills.pro/# online pharmacy without a prescription

Howarddrend

June 30, 2023 at 12:36 PM

http://paxlovid.pro/# paxlovid cost without insurance

ZacharyPaync

June 30, 2023 at 4:55 PM

paxlovid india: paxlovid pharmacy – buy paxlovid online

Howarddrend

June 30, 2023 at 7:22 PM

https://paxlovid.pro/# Paxlovid buy online

ZacharyPaync

July 1, 2023 at 12:04 AM

onlinecanadianpharmacy 24: certified canadian pharmacy – canada drugs online reviews

Gregorytig

July 1, 2023 at 12:04 AM

cheap birth control pills birth control pills birth control pills without seeing a doctor

Howarddrend

July 1, 2023 at 3:44 AM

http://canadianpharm.pro/# canadian pharmacy com

Brianzen

July 1, 2023 at 6:17 AM

paxlovid generic: paxlovid price – paxlovid for sale

Ralphalard

July 1, 2023 at 8:20 AM

http://paxlovid.pro/# Paxlovid over the counter

ZacharyPaync

July 1, 2023 at 10:07 AM

thecanadianpharmacy: canadian pharmacy cheap medications – canadian pharmacy no scripts

Brianzen

July 1, 2023 at 1:49 PM

canadapharmacyonline legit: canadian pharmacy shipping to USA – maple leaf pharmacy in canada

Howarddrend

July 1, 2023 at 2:09 PM

http://birthcontrolpills.pro/# birth control pills delivery

Gregorytig

July 1, 2023 at 4:50 PM

paxlovid for sale paxlovid cost without insurance buy paxlovid online

ZacharyPaync

July 1, 2023 at 8:13 PM

cheap birth control pills: birth control pills prescription – buy birth control over the counter

Ralphalard

July 1, 2023 at 8:22 PM

https://canadianpharm.pro/# buying from canadian pharmacies

Brianzen

July 1, 2023 at 9:04 PM

birth control pills prescription: price for birth control pills – birth control pills prescription

Howarddrend

July 2, 2023 at 12:41 AM

https://paxlovid.pro/# п»їpaxlovid

Brianzen

July 2, 2023 at 5:50 AM

п»їpaxlovid: paxlovid covid – Paxlovid buy online

Gregorytig

July 2, 2023 at 10:35 AM

birth control pills prescription birth control pills online birth control pills

Howarddrend

July 2, 2023 at 11:12 AM

https://canadianpharm.pro/# the canadian pharmacy

Ralphalard

July 2, 2023 at 12:00 PM

http://canadianpharm.pro/# canadian drug pharmacy

ZacharyPaync

July 2, 2023 at 4:32 PM

buy drugs from canada: canadian pharmacy 24 – pharmacy in canada

Brianzen

July 2, 2023 at 5:38 PM

paxlovid generic: paxlovid pharmacy – paxlovid price

Maryflerm

July 2, 2023 at 8:13 PM

atarax weight loss

Howarddrend

July 2, 2023 at 9:46 PM

https://birthcontrolpills.pro/# birth control pills

ZacharyPaync

July 3, 2023 at 2:42 AM

legit canadian online pharmacy: certified online pharmacy canada – canadian pharmacy

Brianzen

July 3, 2023 at 5:18 AM

paxlovid covid: buy paxlovid online – paxlovid pharmacy

twicsy reviews

July 3, 2023 at 6:18 AM

I’ll right away grasp your rss feed as I can’t to find your e-mail

subscription link or e-newsletter service.

Do you’ve any? Please let me recognize so that I may just subscribe.

Thanks.

Ralphalard

July 3, 2023 at 6:47 AM

https://canadianpharm.pro/# canada pharmacy online legit

Howarddrend

July 3, 2023 at 8:20 AM

http://canadianpharm.pro/# canadian pharmacy online reviews

buy instagram followers cheap

July 3, 2023 at 8:34 AM

My brother recommended I might like this blog.

He was totally right. This post truly made my day.

You cann’t imagine simply how much time I had spent for

this information! Thanks!

Gregorytig

July 3, 2023 at 10:12 AM

canada drug pharmacy canadian medications canada pharmacy online

ZacharyPaync

July 3, 2023 at 12:53 PM

paxlovid buy: paxlovid pill – п»їpaxlovid

Brianzen

July 3, 2023 at 5:05 PM

legal canadian pharmacy online: northern pharmacy canada – canadian king pharmacy

Howarddrend

July 3, 2023 at 6:54 PM

http://birthcontrolpills.pro/# birth control pills without seeing a doctor

купить чеки на гостиницу в санкт петербурге

July 3, 2023 at 7:20 PM

What i do not realize is in reality how you’re now not really a lot more smartly-favored than you may be right now. You are so intelligent. You know therefore significantly relating to this matter, produced me personally consider it from so many numerous angles. Its like men and women don’t seem to be interested unless it’s something to accomplish with Lady gaga! Your personal stuffs great. All the time deal with it up!

ZacharyPaync

July 3, 2023 at 11:03 PM

certified canadian pharmacy: canadian pharmacy sarasota – canadian family pharmacy

Davidswelo

July 3, 2023 at 11:10 PM

500 mg valtrex daily

Ralphalard

July 4, 2023 at 12:28 AM

https://canadianpharm.pro/# canadian pharmacy meds reviews

Brianzen

July 4, 2023 at 3:15 AM

Paxlovid over the counter: Paxlovid buy online – paxlovid for sale

Howarddrend

July 4, 2023 at 5:27 AM

http://paxlovid.pro/# paxlovid pharmacy

Gregorytig

July 4, 2023 at 7:20 AM

paxlovid generic buy paxlovid online paxlovid pharmacy

ZacharyPaync

July 4, 2023 at 9:13 AM

Paxlovid over the counter: paxlovid cost without insurance – Paxlovid buy online

Brianzen

July 4, 2023 at 12:52 PM

birth control pills prescription: birth control pills online – birth control pills cost

Howarddrend

July 4, 2023 at 4:00 PM

https://canadianpharm.pro/# best canadian pharmacy online

Ralphalard

July 4, 2023 at 4:18 PM

http://canadianpharm.pro/# canada drugs reviews

купить чеки на гостиницу в санкт петербурге

July 4, 2023 at 5:42 PM

I’m really enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Outstanding work!

ZacharyPaync

July 4, 2023 at 7:25 PM

over the counter birth control pills: birth control pills online – birth control pills without seeing a doctor

Brianzen

July 4, 2023 at 10:34 PM

safe canadian pharmacy: certified online pharmacy canada – canadian pharmacy service

Howarddrend

July 5, 2023 at 2:34 AM

http://birthcontrolpills.pro/# cheap birth control pills

Gregorytig

July 5, 2023 at 3:09 AM

paxlovid price paxlovid covid paxlovid cost without insurance

Anthonyfleno

July 5, 2023 at 5:48 AM

http://mexicanpharmacy.life/# mexican border pharmacies shipping to usa

discount canadian pharmacy

July 5, 2023 at 7:11 AM

compare prescription drug prices

buy 10000 instagram followers for $1

July 5, 2023 at 7:19 AM

Wow, that’s what I was looking for, what a data! present here at this blog,

thanks admin of this web site.

DerekVok

July 5, 2023 at 10:38 AM

mexican border pharmacies shipping to usa: mexican pharmaceuticals online – buying from online mexican pharmacy

how much to buy followers on instagram

July 5, 2023 at 11:17 AM

Everything is very open with a really clear clarification of the challenges.

It was definitely informative. Your site is very helpful.

Thanks for sharing!

best mexican online pharmacies

July 5, 2023 at 12:02 PM

no prescription canadian pharmacy

KevinDup

July 5, 2023 at 12:24 PM

http://indiapharmacy.world/# world pharmacy india

Anthonyfleno

July 5, 2023 at 12:35 PM

http://mexicanpharmacy.life/# reputable mexican pharmacies online

WilbertDyevy

July 5, 2023 at 2:22 PM

п»їlegitimate online pharmacies india: india online pharmacy – buy medicines online in india

online casino fake money

July 5, 2023 at 5:07 PM

Hi there! This post couldn’t be written any better! Reading this post reminds me of my good old room mate! He always kept talking about this. I will forward this post to him. Pretty sure he will have a good read. Thank you for sharing!

DerekVok

July 5, 2023 at 5:33 PM

best ed medications: best pill for ed – pills erectile dysfunction

Anthonyfleno

July 5, 2023 at 8:06 PM

http://edpills24.pro/# online ed medications

Sueflerm

July 5, 2023 at 8:09 PM

metformin online canada drug

KevinDup

July 5, 2023 at 9:09 PM

https://edpills24.pro/# cheap erectile dysfunction pills online

discount prescription drugs

July 5, 2023 at 10:33 PM

canadian pharmacy no rx

Richardsquab

July 5, 2023 at 11:16 PM

atenolol no prescription

Richardhaity

July 5, 2023 at 11:23 PM

mexico drug stores pharmacies п»їbest mexican online pharmacies mexican pharmaceuticals online

DerekVok

July 6, 2023 at 4:10 AM

buying prescription drugs in mexico: buying prescription drugs in mexico – mexican border pharmacies shipping to usa

Anthonyfleno

July 6, 2023 at 6:20 AM

http://indiapharmacy.world/# indianpharmacy com

WilbertDyevy

July 6, 2023 at 8:10 AM

generic ed drugs: impotence pills – best pill for ed

KevinDup

July 6, 2023 at 8:21 AM

http://indiapharmacy.world/# Online medicine home delivery

Davidswelo

July 6, 2023 at 2:05 PM

albuterol price in mexico

DerekVok

July 6, 2023 at 2:48 PM

mexico pharmacies prescription drugs: п»їbest mexican online pharmacies – mexico pharmacies prescription drugs

Anthonyfleno

July 6, 2023 at 4:31 PM

http://edpills24.pro/# top ed drugs

KevinDup

July 6, 2023 at 7:27 PM

https://indiapharmacy.world/# buy medicines online in india

Richardhaity

July 6, 2023 at 10:06 PM

buy medicines online in india indian pharmacy Online medicine order

daachka.ru

July 6, 2023 at 11:01 PM

We are a gaggle of volunteers and starting a new scheme in our community. Your site provided us with helpful information to work on. You have performed an impressive process and our whole community might be grateful to you.

WilbertDyevy

July 7, 2023 at 1:07 AM

medications for ed: non prescription ed drugs – best erectile dysfunction pills

DerekVok

July 7, 2023 at 1:16 AM

best online pharmacies in mexico: buying from online mexican pharmacy – reputable mexican pharmacies online

Anthonyfleno

July 7, 2023 at 2:39 AM

https://mexicanpharmacy.life/# mexican rx online

KevinDup

July 7, 2023 at 6:26 AM

https://indiapharmacy.world/# indianpharmacy com