Opinion

Mining Industry Overview and Challenges

Mining for natural resources provides the basic inputs to everything we use: electronics, transport technologies, the building industry – almost everything that surrounds us would be either severely limited or impossible were it not for mining providing the raw materials. In this very real sense, metals form the basis of our modern economy and lifestyle. Metals (and other commodities) are a fundamental store of value. Major metals are freely exchangeable for fiat currency and traded on open exchanges. In this way, there is an analogy between metals and crypto-currencies with the critical distinction, of course, that metals are physical items that often have important industrial uses. In fact, for much of human history, gold has been money.

Even in this era of fiat currency (theoretically decoupled from the gold standard), gold remains a preferred means of storing value. It is normal in the mining industry to quote the resource present in “gold equivalent” value, in essence assuming a free exchange between gold and all other metals; again an analogy to crypto-currency exchanges. While many people know of the major mining companies – organizations such as BHP, Rio Tinto and Teck – the majority of mines, especially at the early-stage of development of new resources, are operated by small companies. Those are either privately held entities or are small-cap listed companies.

Early-stage mining projects are vital to the mining industry as successful early projects grow and are often acquired by “the majors”. As such, early stage mines are critical to our ability to continue to grow and develop our advanced economies and, indeed, our civilization. Right now, globally, there are well in excess of five thousand exploration or early-stage mining projects, collectively seeking more than $25 billion in funding. Early-stage mining projects are risky, speculative ventures and many of them will never reach production. However, some will provide extraordinary returns for early participants. The key, as ever, is being able to invest in the right project at the right time.

Mining Lifecycle Challenges

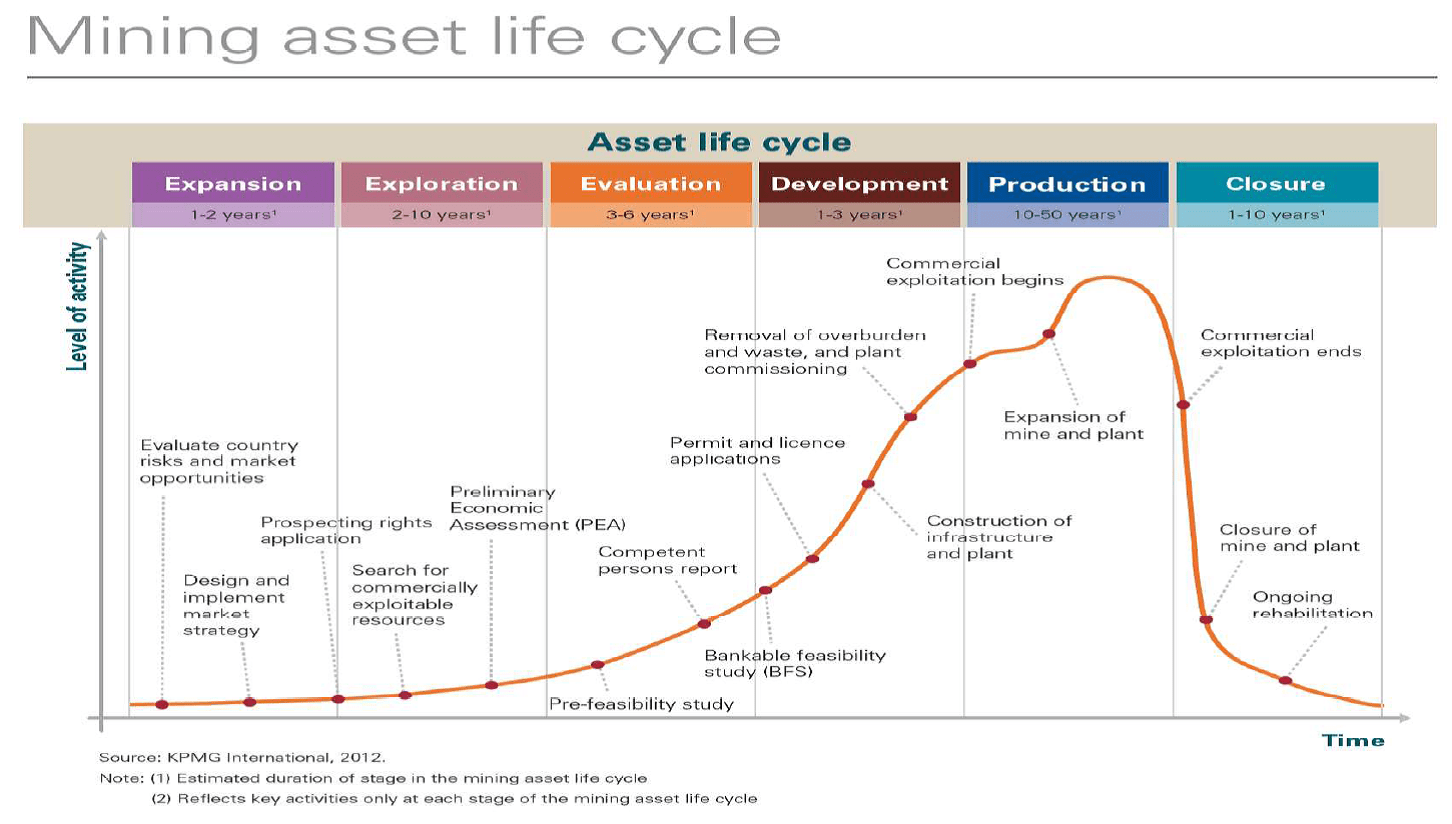

Each mine has distinct life stages and unique challenges. As with any business, the early stages are the most risky, with many questions to be addressed: is there an economically viable resource present? Will the market price of the commodity remain strong? Can the resource be recovered in a technically efficient and cost-effective way? Are there processing facilities within an economical trans- port distance? Will the regulatory environment support the operations? Can the team deliver the project effectively? As a mine progresses through its lifecycle, these risks are reduced or removed as greater certainty of the resource is obtained and production commences.

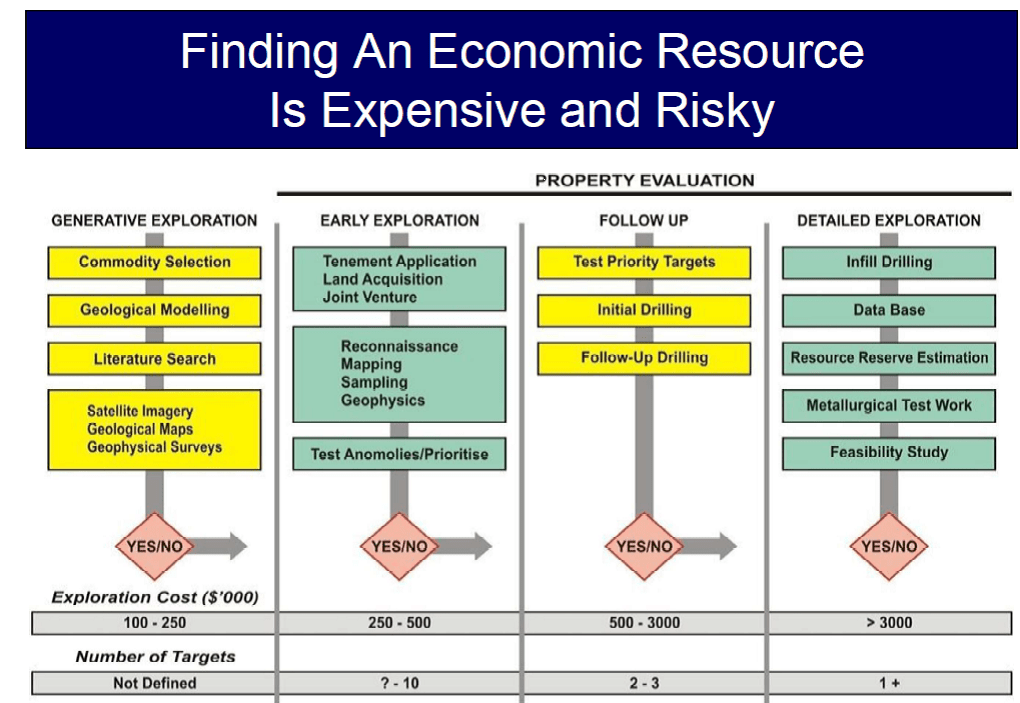

The first stage, prospecting, aims to locate potential sources of ore based on analysis of geological data and field visits to promising sites. The costs are contained and the risk lies in the potential to waste a lot of time and not find anything of substantial enough value. Risk mitigation during this stage is based on expert geological assessment and intelligent data gathering and analysis.

During the exploration stage, the miner gains a clearer understanding of how much metal is present, how well defined the ore-body is and how the ore can be extracted and processed. This is done via a range of techniques including surface analysis, magnetics and drilling to take core samples to establish the scope and estimated grade and tonnage of an ore-body. A basic “go or no-go” decision can be reached quite early, based on different scenarios of pricing of the resource and other factors. Depending on scale, this stage can cost in the order of $1 million to $15 million (or more for large projects) and can include several rounds of drilling and analysis to define and expand the resource to determine the grade, tonnage and extent of the ore-body. A key aim is to obtain a JORC 2012 compliant resource. JORC 2012 (Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves) is a global industry standard.

Once data sufficient to demonstrate the viability of a project is obtained, the development stage is planned. Development is less risky because there is a firm plan to extract and process the ore, but capital costs of setting up the facilities to do so are growing fast. Planning and building a mine can require capital of anywhere from $10 million to well over $100 million. This capital requirement at this stage is the reason why many projects are sold prior to commencement of the development stage. It is akin to a small biotech startup doing the initial development and then selling the proposed drug to a major pharmaceutical firm to do clinical trials and global marketing.

The extraction stage is where revenue commences and capital costs are generally much lower. Capital expenditure becomes operating expenditure, and that is commensurate with the amount of ore being mined and metal produced. Assuming the exploration and development stages have been done correctly and the commodity prices remain strong, this is where the profit of the project is made. Ideally, the extraction stage will last several years so that initial capital expenditure can be recouped and profits derived. During this stage, most mines continue to do exploration work to expand the resource (how much payable material is identified) and extend the mine life (how long the mine can profitably produce.)

Sometimes operating mines go back to the market to raise additional capital to fund further exploration and development. Such follow-on exploration is generally considered much lower risk than initial exploration because some re-source has already been demonstrated to exist. There may be larger swathes of adjoining land to be explored, or more concentrated effort needed in a particular location.

While they are operating, mines need to make provision for shut-down and environmental remediation costs. Many jurisdictions require mines to put up substantial environmental bonds to ensure that the clean up will be undertaken. This happens at the end of a mine’s life, once all economically accessible resource has been extracted.

The Investing Challenge

As the process of raising capital can be slow and difficult so, too, the process of bringing mining assets into liquidity is slow and inefficient. There can be a delay of many months, or even years, until investors can get their money out. And all this assumes that the many steps involved in bringing a mining project to production actually happen while the commodity price remains sufficiently strong to provide an economic return. Many investment funds and professional investors stay away due to:

- Lack of trust and transparency – investors don’t know the promoters or the asset, and it can be difficult to get clear and accurate information on a given project

- Risk of illiquidity – units in a private or unlisted company are hard to sell or dispose of unless the entity is sold or floated, and lead time to production (and hence revenue) can be several years

- Perceived lack of transparency for use of funds.

Pingback: Mining Industry Overview and Challenges – The Crypto News

Rejestracja

May 7, 2023 at 4:35 PM

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/pl/register?ref=RQUR4BEO