Financial Regulation

Report: ‘Smart Securities’ as the Evolution for Security Tokens

If 2017 was the year of the ICO, many in the industry have been trying to figure out when will be the year of the Security Token Offering. Will it be 2019? Blockchain Beach obtained a report from Ownera and NovaBlock Capital, entitled “The State of Smart Securities: 2019,” which discussed the potential for the sector and proposed a new name for Security Tokens.

Smart Securities

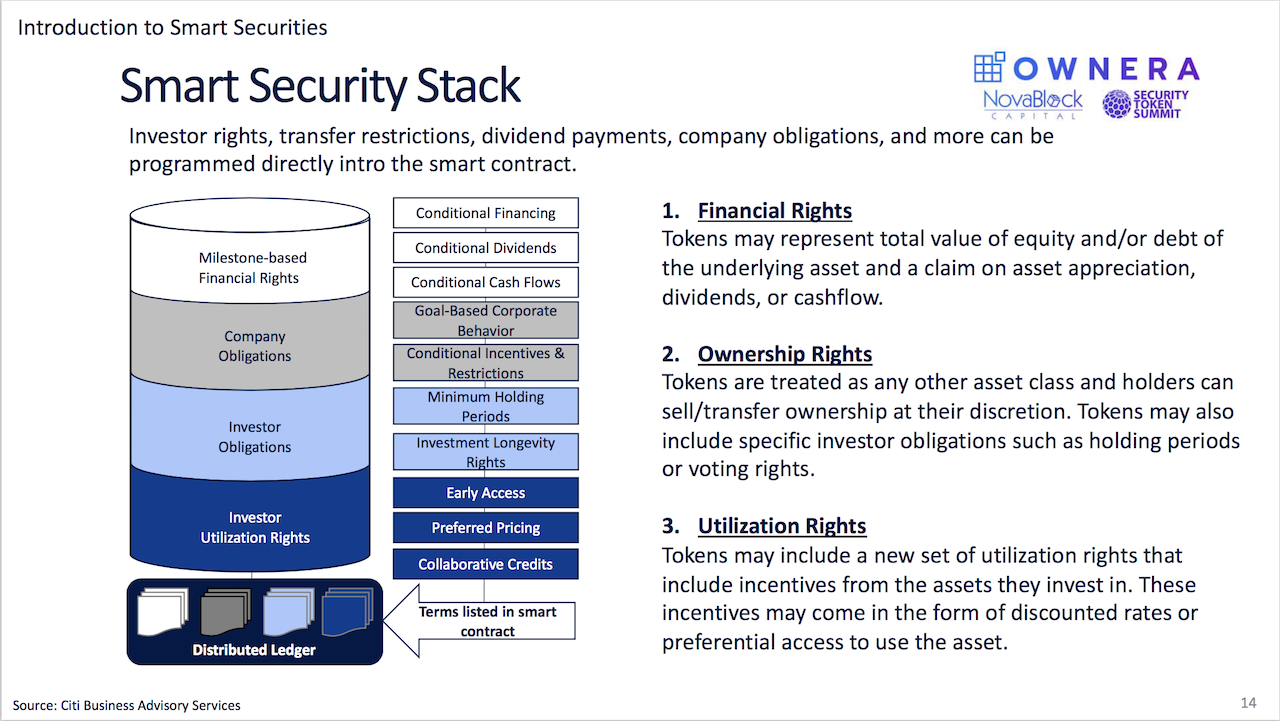

The report argues for a common nomenclature for this investment vehicle and believes that “Smart Securities” provides a more descriptive name. To them, the point is not that the investment is a token, but more what the token can enable. This is how they envision the Smart Securities Stack:

This infrastructure provides benefits to the capital formation process, including:

- Fractional Ownership – Creating a lower barrier to entry and a wider pool of capital for investments like Real Estate

- 24/7 Global Markets – For global pools of liquidity and the ability to manage a diversified portfolio of investments without being subject to US market hours

- Automated Compliance – With regulatory requirements coded into the tokens, this decreases costs for both issuers and regulators

- Rapid Settlement – Decreasing settlement time from 3+ days to near instant settlement

- Increased Liquidity – Previously illiquid assets can be bought by a wider pool of investors due to ease of transaction and ability to have fractional ownership

2019 and Beyond

With 2019 as the target year, it is still fair to say that progress was made in 2018, including:

This bodes well for the future, but there are noted challenges:

- Liquidity – There is still a chicken and the egg situation for this proposed benefit. It is expected that exchange volume will be low while organic liquidity builds and investors become comfortable with the technology and asset class.

- Regulatory Compliance – Although some compliance can be automated, there will still need to be some manual processes around Know Your Customer (KYC), Anti-Money Laundering (AML), and other regulations to ensure that new technology is fully compliant. They also hope that strict accredited investor regulations will be relaxed to include more potential investors.

- Custody and Insurance – Companies in the space are working to become regulated custodians, but there is not currently a trusted player in the space, like State Street is for traditional markets.

- Digital Identity – Self sovereign identity solutions will help to protect investor data.

We will see how quickly this comes to be, but the report includes a meaningful quote from University of Oregon Professor Stephen McKeon:

“As the world’s assets become increasingly liquid, the concept of ownership will evolve in ways we cannot yet imagine.”

You can download the full report for free at DigitalSecuritiesReport.io.

Pingback: Report: ‘Smart Securities’ as the Evolution for Security Tokens – The Crypto News

conta da binance

May 5, 2023 at 3:56 AM

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/pt-BR/register?ref=PORL8W0Z

Kayıt Ol | Gate.io

May 11, 2023 at 4:56 AM

At the beginning, I was still puzzled. Since I read your article, I have been very impressed. It has provided a lot of innovative ideas for my thesis related to gate.io. Thank u. But I still have some doubts, can you help me? Thanks.