Exchanges

What are Stablecoins and Why are they Necessary?

What is a Stablecoin?

Stablecoins are cryptocurrencies that are designed to keep their value constant relative to another asset, such as the U.S. dollar. There are various approaches that can be used to accomplish this goal which will be discussed more in depth later.

Why are Stablecoins necessary?

Cryptocurrencies are volatile. The price of Bitcoin, and other cryptocurrencies are always changing, which makes them difficult to use as a medium of exchange. For instance, if a fund company had $100 million on Monday, come Tuesday, they should expect to have the same amount of value. If they were using Bitcoin or other cryptocurrency, the value could be $90 million on Tuesday and $110 million on Wednesday.

This amount of fluctuation is fine if cryptocurrency is being used as a speculative investment, but to use it as a medium of exchange would be difficult. Changes of million of dollars in a day’s time are not acceptable for storing this much value. Stablecoins attempt to solve this problem by pegging its value to some other asset in order to keep its value constant.

Stablecoins provide the convenience and speed of using other cryptocurrencies without the volatility. One advantage of having a stablecoin on the blockchain is that it allows users to move funds quickly. Instead of waiting days for the traditional banking system to move funds around, a stablecoin can move the same funds in seconds. Stablecoins also provide more liquidity to markets due to increased fund transfer speeds.

Using a stablecoin is advantageous to using a Venmo-style payment processor because of the limited trust required and increased transparency provided by blockchain. Although moving large amounts of money is not Venmo’s use case, microtransactions using Venmo require more time and more trust than stablecoins. Paypal users have fees when using a debit or credit card and bank settlements take days. Stablecoins have some advantages over Paypal because they have lower fees and require much shorter transfer times. Another advantage is that users have control of their own money. Both Venmo and Paypal can restrict users from sending and receiving money, whereas no one can restrict users from using stablecoins.

Types of Stablecoins

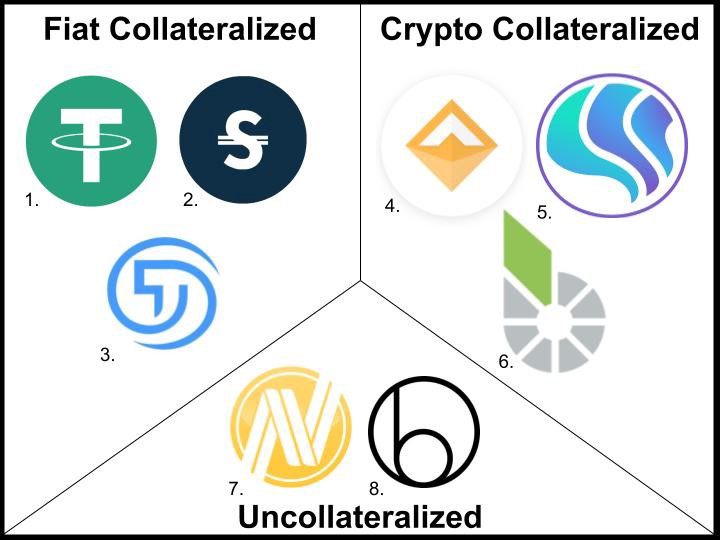

There are three main types of stablecoins, two of which rely on an underlying asset for collateral, the third of which relies on market trust due to the stablecoin not being collateralized by another valuable asset.

Fiat Collateralized

These stablecoins are tokenized currency. They rely on the issuer to keep a reserve of the underlying asset (such as the U.S. dollar), they then create stablecoins equivalent to the amount of the underlying asset they have. For example, if they have $1 million in their reserve, they would mint 1 million stablecoins priced at $1 each.

Tether was the first company to attempt this feat and so far they have the largest market share by a wide margin. Many new and more transparent companies are beginning created in an attempt to topple Tether’s monopoly.

Cryptocurrency Collateralized

These stablecoins require more upkeep than fiat collateralized stablecoins. Cryptocurrency collateralized stablecoins are backed by pool of cryptocurrency. The stablecoins are over collateralized in order withstand a drop in value of the underlying asset. If there are 100 stablecoins each valued at $1.00 ($100 total value) then there would be $150 or $200 worth of collateral in the form of cryptocurrency.

Back in in 2014, Bitshares created a coin called BitUSD designed to stay pegged to U.S. dollars. The coin is relatively stable in price, but still fluctuates. MakerDAO burst onto the scene in 2017 and is so far over twice as large as BitUSD. Using Ethereum as a platform, MakerDAO has become the largest crypto collateralized stablecoin and will most likely keep this title.

Uncollateralized

These stablecoins rely on controlling the coin supply relative to demand in order to keep the value of the asset stable. Using basic supply and demand theory, these coins increase the supply when their value is too great, and reduce their supply when the value is too little, attempting to keep the price constant. This model often requires a form of IOU to shrink the supply called Seigniorage Shares.

NuBits has been attempting to keep their coin pegged to the dollar for the last 4 years, but the peg has broken multiple times. As of the writing of this article the price of 1 NuBit is $0.15 and the price does not look like it will recover any time soon. Most recently, Basis (previously Basecoin) raised $133 million for their uncollateralized stablecoin project and are yet to launch.

Market Overview of Stablecoins (with associated protocol)

- Tether — Omni layer (Bitcoin and Ethereum ERC-20 Token)

- Stably — Blockchain agnostic (currently ERC-20 Token)

- TrueUSD — Ethereum (ERC-20 Token)

- MakerDAO — Ethereum (ERC-20 Token)

- AuroraDAO – Ethereum (ERC-20 Token)

- bitUSD — Bitshares

- NuBits — Independent

- Basis — Independent

Tradeoffs of Each System

Each of the three types of stablecoins require some trade offs, none of the three are perfect, but some tradeoffs are worse than others.

Centralized vs. Decentralized

All three models rely on differing degrees of centralization. Centralization of asset control can lead to instability if the central party does not behave in a just manner. For instance, a fiat collateralized token must be audited regularly to prevent them from making more coins than there are dollars in reserve.

Crypto collateralized stablecoins do not suffer from centralization because they rely on the consensus of users to operate, the same applies to uncollateralized stablecoins. Both crypto collateralized and uncollateralized stablecoins require an honest Oracle to provide the exchange rate of the coin. In order to regulate supply of the coin and create an accurate amount the Oracle must be honest. If the price of Basis is $1.00 on the market, but the users report the price to be $1.20 the software will create more Basis tokens in an attempt to fix the price discrepancy, however in this case it would drive the price below $1.00, breaking the peg to USD.

Some projects are attempting to create a decentralized oracle, one that would not require trust, but these projects are still under development.

Efficiency vs. Inefficient Capital

The efficiency of the capital usage varies in each model. The efficiency depends on the amount of collateral required and the way in which this collateral is maintained. Fiat collateralized systems are very efficient because the amount of collateral is exactly equal to the value of the coins.

Crypto collateralized systems suffer from being overcollateralized. Due to the intense volatility of cryptocurrencies the collateral in these systems must account for that which causes them to be inefficient. Uncollateralized systems are perfectly efficient because they require no collateral to be stored.

Collateralized vs. Uncollateralized

The usage of collateral gives the underlying coins inherent value because the coin is always redeemable for that collateral. Fiat collateralized systems have the strongest collateral because the strength of a national currency is greater than most other forms of collateral.

Crypto collateralized systems do have collateral, but the collateral is less stable than other forms of collateral, for this reason more collateral is required than there are coins issued. The use of the collateral is only as effective as the value of the collateral itself. Cryptocurrencies are highly speculative and volatile so their use in this system relies on the underlying assumption that they will continue to have value.

Uncollateralized systems have no collateral and therefore have no underlying asset to derive their value from. As mentioned above, the lack of collateral makes an uncollateralized coin have fragile stability, if the trust in the holders is gone the value of it can unwind quickly.

The Future of Stablecoins

There are inherent risks in every model of stable coin. The two most important features of a stable coin are the ability to keep funds safe and to stay constant in its price. The three discussed methods all have merits, but all carry some risk. Fiat-collateralized stablecoins require trust, crypto-collateralized tokens cannot handle large amounts of volatility and still require some trust, and uncollateralized tokens carry the risk of a price death spiral due to lost faith in the assets value.

It is likely that exchanges will continue to use centralized stable coins in the near future. Tether is the most pervasive stable coin, and large exchanges such as Binance, Bittrex, and Bitfinex continue to use it. For institutions and exchanges, the tradeoff of decentralization for price stability and legal guarantees may not be worth it. The market will decide which of the three ideas will be the most successful, but until the decentralized systems become more robust, users will turn to the more centralized methods, especially big market players.

Disclaimer: Do not take this article as investment advice, but rather for educational purposes. I am not a financial manager or professional asset manager.

Pingback: Binance Hacked and Bitfinex Tether'd: On Keeping Assets Safe

Cel mai bun cod de recomandare Binance

April 30, 2023 at 3:30 AM

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/ro/register?ref=B4EPR6J0

spravki-kupit.ru

June 27, 2023 at 1:18 AM

медицинская справка 2023

купить диплом о высшем образовании гознак

June 27, 2023 at 9:52 PM

Excellent post. I’m going through some of these issues as well..

bezogoroda.ru

July 3, 2023 at 12:45 PM

My brother suggested I might like this website. He was totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

гостиничные чеки купить спб

July 3, 2023 at 9:43 PM

It’s really a nice and helpful piece of information. I’m satisfied that you shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

купить чеки на гостиницу в санкт петербурге

July 4, 2023 at 8:09 PM

Hi to all, the contents present at this web site are truly awesome for people experience, well, keep up the nice work fellows.

free casino games

July 5, 2023 at 7:28 PM

If you desire to get much from this article then you have to apply such techniques to your won website.

daachka.ru

July 6, 2023 at 4:15 PM

When someone writes an article he/she maintains the idea of a user in his/her mind that how a user can know it. Thus that’s why this article is great. Thanks!